What are low-cost index funds?

Index funds are a type of mutual fund or exchange-traded fund (ETF) that tracks a particular index. This means that the fund’s performance is directly tied to the performance of the index it tracks.

For example, if you invest in an S&P 500 index fund, your returns will be directly correlated with the performance of the S&P 500 index.

Index funds are considered to be a low-cost investment option because they have very low expense ratios. This means that a smaller percentage of your investment is used to pay for fees, which allows you to keep more of your money invested.

Index funds are also very tax-efficient, as they do not generate taxable capital gains distributions. This is because index funds are not actively managed, so there is no trading activity that can generate capital gains.

Overall, index funds are a great option for investors who are looking for a low-cost, tax-efficient way to invest. They are a good choice for both long-term investors and those who are looking for a more hands-off approach to investing.

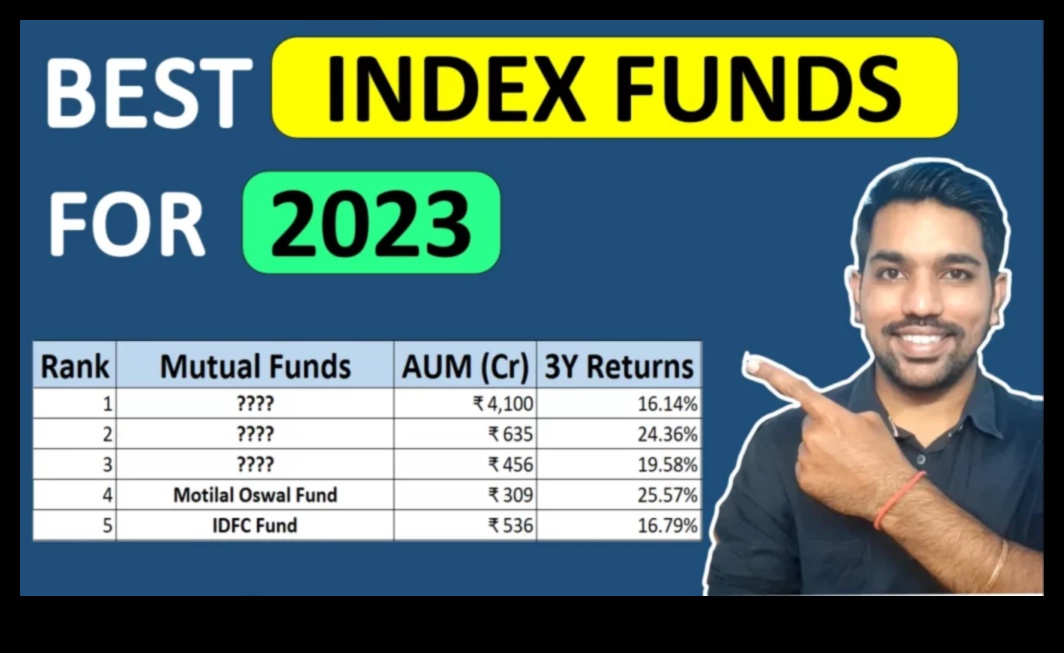

Best low-cost index funds

There are many different low-cost index funds available, but some of the best options include:

- Vanguard S&P 500 ETF (VOO)

- iShares Core S&P 500 ETF (IVV)

- Charles Schwab S&P 500 ETF (SPY)

- Vanguard Total Stock Market ETF (VTI)

- iShares Core Total Stock Market ETF (ITOT)

- Charles Schwab Total Stock Market ETF (SCHB)

These funds all have very low expense ratios and track major stock market indexes. They are a great choice for investors who are looking for a diversified, low-cost way to invest in the stock market.

How to choose an index fund

When choosing an index fund, there are a few things you should consider:

- The index the fund tracks

- The expense ratio

- The tax efficiency

- The minimum investment

- The trading costs

Once you have considered these factors, you can narrow down your choices and select the best index fund for your needs.

How to invest in index funds

Investing in index funds is very easy. You can do so through a brokerage account or through a robo-advisor.

To invest through a brokerage account, you will need to open an account with a broker, such as Fidelity, Vanguard, or Charles Schwab. Once you have opened an account, you can simply transfer money into your account and then purchase the index funds you want to invest in.

To invest through a robo-advisor, you will need to create an account with a robo-advisor, such as Betterment, Wealthfront, or Ellevest. Once you have created an account, you will need to answer a few questions about your financial goals and risk tolerance. The robo-advisor will then create a portfolio of index funds for you.

Tax implications of investing in index funds

Index funds are generally very tax-efficient. This is because they do not generate taxable capital gains distributions. However, there are some exceptions to this rule.

For example, if you sell an index fund that has appreciated in value, you will owe capital gains taxes on the profit. Additionally, if an index fund holds stocks that pay dividends, you will owe taxes on those dividends.

Overall, index funds are a very tax-efficient investment option. However, it is important to be aware of the potential tax implications before you invest.

Risks of investing in index funds

There are always risks associated with investing, and index funds are no exception. Some of the risks associated with investing in index funds include:

II. What are index funds?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a particular market index. This means that the fund’s returns will closely mirror the returns of the index it is tracking.

For example, if you invest in an S&P 500 index fund, your returns will be closely correlated with the returns of the S&P 500 index. This is because the fund will hold a portfolio of stocks that are representative of the S&P 500 index.

Index funds are a popular investment option for investors who are looking for a low-cost, passive investment strategy. Passive investing means that you do not need to actively manage your investments. Instead, you simply invest in an index fund and let the fund manager do the work of picking stocks and rebalancing the portfolio.

Index funds are typically very low-cost, which makes them a good option for investors who are on a budget. They are also very tax-efficient, as they do not generate much in the way of capital gains distributions.

Overall, index funds are a great option for investors who are looking for a low-cost, passive investment strategy. They are a good way to get exposure to the stock market without having to do a lot of research or actively manage your investments.

II. What are index funds?

An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a particular index. This means that the fund’s returns will closely mirror the returns of the index it is tracking.

Index funds are a popular investment choice for investors of all experience levels because they are relatively low-cost, diversified, and passive.

Here are some of the key benefits of investing in index funds:

- Low cost: Index funds are typically much cheaper than actively managed funds. This is because they do not have the same high fees as actively managed funds, which need to pay for the salaries of their investment managers and other expenses.

- Diversification: Index funds invest in a wide range of stocks or bonds, which helps to reduce risk. This is in contrast to actively managed funds, which often focus on a smaller number of stocks or bonds.

- Passivity: Index funds are passive investments, which means that they do not require active management. This can be a major advantage for investors who do not have the time or expertise to manage their own investments.

Overall, index funds are a great option for investors who are looking for a low-cost, diversified, and passive investment.

IV. Best low-cost index funds

There are many different low-cost index funds available, but some of the best options include:

- Vanguard Total Stock Market Index Fund (VTI) – This fund tracks the CRSP U.S. Total Market Index, which is a broad-based index of stocks from all sectors of the U.S. economy.

- iShares Core S&P 500 ETF (SPY) – This fund tracks the S&P 500 Index, which is a market-cap-weighted index of the 500 largest companies in the U.S.

- Fidelity Total Market Index Fund (FSKAX) – This fund tracks the Fidelity® U.S. Total Market Index, which is a broad-based index of stocks from all sectors of the U.S. economy.

These are just a few of the many low-cost index funds that are available. By investing in a low-cost index fund, you can potentially achieve market-level returns with minimal risk.

V. How to choose an index fundThere are a few things to consider when choosing an index fund.

- The asset class

- The investment style

- The expense ratio

- The minimum investment

- The historical performance

Let’s take a closer look at each of these factors.

Asset class

The first thing you need to decide is what asset class you want to invest in. There are a variety of different index funds available, each of which tracks a different asset class.

- Stock index funds track the performance of a specific stock market index, such as the S&P 500 or the Nasdaq 100.

- Bond index funds track the performance of a specific bond market index, such as the Bloomberg Barclays U.S. Aggregate Bond Index.

- Alternative index funds track the performance of a non-traditional asset class, such as commodities or real estate.

Once you’ve decided which asset class you want to invest in, you can start to narrow down your choices.

Investment style

The next thing you need to consider is the investment style of the index fund. There are two main types of index funds: passive and active.

- Passive index funds simply track the performance of an underlying index. They do not attempt to outperform the market, and they have very low expense ratios.

- Active index funds try to outperform the market by actively trading the stocks in their portfolios. They have higher expense ratios than passive index funds, but they may also offer higher returns.

The decision of whether to invest in a passive or active index fund is a personal one. There is no right or wrong answer.

Expense ratio

The expense ratio is an important factor to consider when choosing an index fund. It is the fee that the fund manager charges to manage the fund.

Index funds typically have very low expense ratios, which is one of the reasons why they are such a popular investment choice. Active index funds, on the other hand, often have higher expense ratios.

It is important to compare the expense ratios of different index funds before making a decision.

Minimum investment

The minimum investment is the amount of money you need to invest in order to open an account with a particular index fund.

Some index funds have very low minimum investments, while others have higher minimum investments.

If you are a beginner investor, you may want to choose an index fund with a low minimum investment.

Historical performance

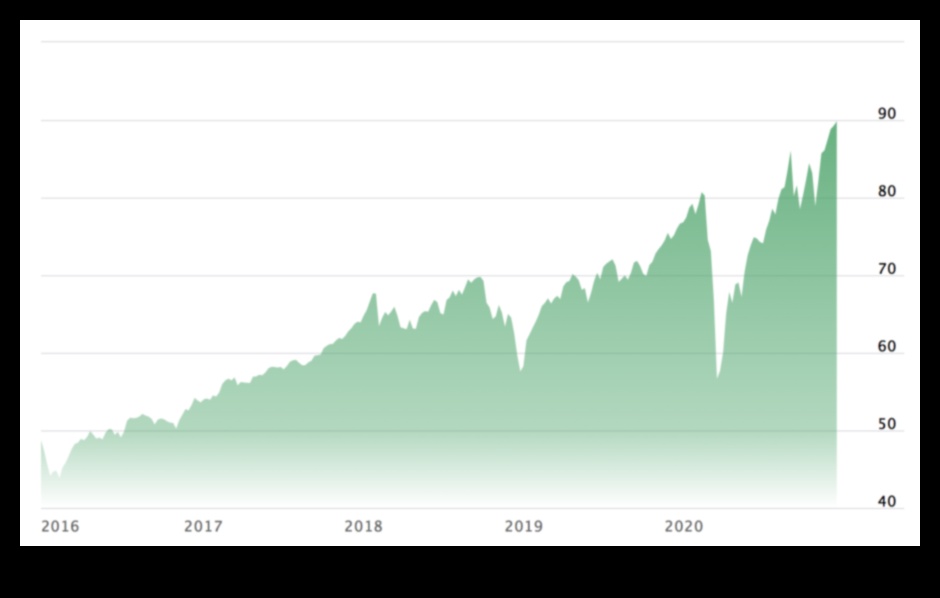

The historical performance of an index fund is another important factor to consider. This will give you an idea of how the fund has performed in the past.

It is important to note that past performance is not necessarily indicative of future results. However, it can still be helpful to look at the historical performance of an index fund when making a decision.

You can find historical performance data for index funds on the websites of the fund companies.

VI. How to invest in index funds

There are a few different ways to invest in index funds. You can do so through a brokerage account, a retirement account, or a 529 plan.

To invest in index funds through a brokerage account, you will need to open an account with a broker. Once you have an account, you can simply search for the index fund you want to invest in and buy shares.

To invest in index funds through a retirement account, you will need to contribute money to your retirement plan. Once you have contributed money to your plan, you can choose to invest your money in index funds.

To invest in index funds through a 529 plan, you will need to open a 529 plan with a financial institution. Once you have a 529 plan, you can choose to invest your money in index funds.

No matter which way you choose to invest in index funds, it is important to do your research and choose a fund that is right for you. You should consider the fund’s investment objective, fees, and track record before making a decision.

VII. Tax implications of investing in index funds

When you invest in an index fund, you are not directly responsible for paying taxes on the fund’s gains. Instead, the fund itself pays taxes on its earnings, and those taxes are passed on to you in the form of lower dividends. This can be a significant advantage for investors who are in a high tax bracket, as it can help to reduce their overall tax liability.

However, it is important to note that index funds are not exempt from all taxes. You will still owe taxes on any capital gains that you realize when you sell your shares of the fund. Additionally, you may also owe taxes on dividends that you receive from the fund, depending on your individual tax situation.

Overall, the tax implications of investing in index funds can be complex. It is important to consult with a tax advisor to make sure that you understand your tax liability before you invest in an index fund.

Risks of investing in index funds

Index funds are generally considered to be a safe investment, but there are some risks associated with them. These risks include:

Market risk: The value of an index fund can go down as well as up. This is because the fund is invested in a variety of stocks, which can be affected by economic conditions, political events, and other factors.

Interest rate risk: When interest rates rise, the value of bonds in an index fund can go down. This is because bonds with lower interest rates become less attractive to investors.

Currency risk: If an index fund is invested in foreign stocks, the value of the fund can be affected by changes in the exchange rate between the U.S. dollar and the currency of the foreign country.

Liquidity risk: Index funds can be illiquid, meaning that it can be difficult to sell them quickly without incurring a loss. This is because index funds typically hold a large number of stocks, which can make it difficult to find buyers for all of the shares at the same time.

Overall, index funds are a relatively safe investment, but there are some risks that investors should be aware of before investing.

IX. Conclusion

Index funds are a great way for investors to build wealth over the long term. They are low-cost, diversified, and passively managed, which makes them a good choice for investors of all experience levels.

If you are looking for a simple and effective way to invest, index funds are a great option. Just be sure to do your research and choose a fund that is right for your goals and risk tolerance.

X. FAQ

Q: What is an index fund?

A: An index fund is a type of mutual fund or exchange-traded fund (ETF) that tracks the performance of a particular index. This means that the fund’s returns will mirror the returns of the index it is tracking, minus the fund’s expenses.

Q: Why should I invest in index funds?

A: There are a number of reasons why you should consider investing in index funds. First, index funds are a low-cost way to invest in the stock market. The fees associated with index funds are typically much lower than the fees associated with actively managed funds.

Q: What are the best low-cost index funds?

A: There are a number of great low-cost index funds available. Some of the most popular include the Vanguard S&P 500 ETF (VOO), the iShares Core S&P 500 ETF (IVV), and the Schwab S&P 500 ETF (SPY).