What is a Donor Advised Fund (DAF)

A donor advised fund (DAF) is a charitable giving vehicle that allows donors to make a tax-deductible contribution to a fund and then recommend grants to charitable organizations over time. DAFs are typically sponsored by a public charity, such as a community foundation or a nonprofit financial institution.

DAFs offer a number of benefits to donors, including:

- Tax benefits: Donors can receive a tax deduction for the full amount of their contribution to a DAF, even if they don’t make any grants from the fund in the same year.

- Flexibility: Donors can recommend grants from their DAF to any qualified charitable organization, at any time.

- Convenience: DAFs are easy to set up and manage. Donors can make contributions online or by mail, and they can recommend grants using a simple online platform.

DAFs are a popular choice for charitable giving for a number of reasons. They offer donors a number of benefits, including tax benefits, flexibility, and convenience. If you’re considering making a charitable gift, a DAF may be a good option for you.

| Topic | Answer |

|---|---|

| What is a Donor Advised Fund (DAF)? | A Donor Advised Fund (DAF) is a charitable giving account that allows donors to make a tax-deductible contribution and then recommend grants to nonprofit organizations over time. |

| How do DAFs work? | DAFs are typically set up at a financial institution, such as a bank or a brokerage firm. Once a donor establishes a DAF, they can make a contribution of cash or other assets. The DAF then invests the donated funds and uses the earnings to make grants to nonprofits. |

| Who can use a DAF? | Anyone can use a DAF, regardless of their income or net worth. |

| What are the benefits of using a DAF? | There are many benefits to using a DAF, including:

|

| What are the risks of using a DAF? | There are few risks associated with using a DAF, but it is important to be aware of the following:

|

What is a Donor Advised Fund (DAF)?

A donor advised fund (DAF) is a philanthropic vehicle that allows donors to make a charitable contribution now and receive an immediate tax deduction, while having the flexibility to recommend grants to charitable organizations over time. DAFs are typically sponsored by a public charity, such as a community foundation or a university, and are managed by a professional investment team.

DAFs offer a number of benefits to donors, including:

- Immediate tax deduction

- Flexibility to recommend grants over time

- Professional investment management

- Convenient and easy to use

If you are interested in learning more about donor advised funds, please visit our website or contact us at [email protected].

II. How do DAFs work?

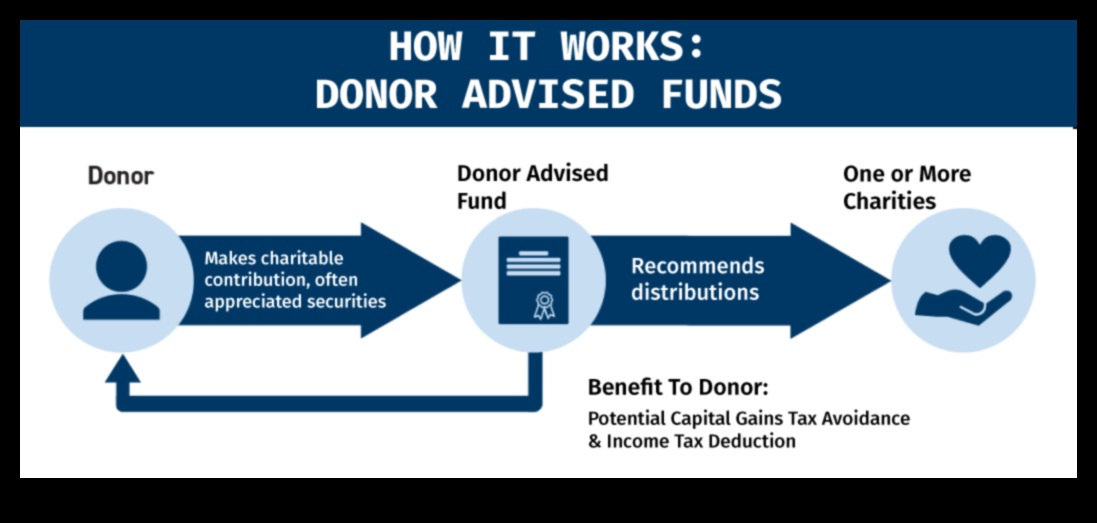

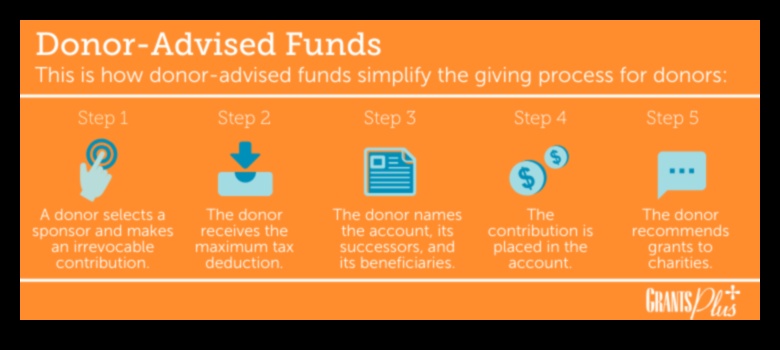

Donor advised funds (DAFs) are charitable giving vehicles that allow donors to make a lump-sum contribution to a fund and then recommend grants to charities over time. DAFs are typically sponsored by a financial institution, such as a bank or a brokerage firm.

When you make a contribution to a DAF, you receive an immediate tax deduction for the full amount of your gift. The DAF then invests your money and grows your donation over time. You can recommend grants from the DAF at any time, and the DAF will disburse the funds to the charities you choose.

DAFs offer a number of benefits to donors, including:

- Immediate tax deduction

- Flexibility to recommend grants over time

- Professional management of your funds

- Convenient way to make charitable gifts

If you are considering making a charitable gift, a DAF may be a good option for you. To learn more about DAFs, please visit the National Association of Donor-Advised Funds.

What is a Donor Advised Fund (DAF)?

A donor advised fund (DAF) is a charitable giving account that allows donors to make a tax-deductible contribution, receive immediate tax benefits, and then recommend grants to nonprofit organizations over time. DAFs are typically sponsored by a financial institution, such as a bank or a brokerage firm.

V. Risks of using a DAF

There are a few risks associated with using a DAF, including:

- The risk of losing control of your money. When you donate money to a DAF, you are essentially giving up control over how it is used. The DAF’s board of directors has the final say on how the money is invested and distributed. This can be a concern for donors who want to ensure that their money is used for specific purposes.

- The risk of fees. DAFs typically charge fees for their services, such as administrative fees and investment fees. These fees can eat into the return on your investment, so it’s important to be aware of them before you donate.

- The risk of fraud. Like any financial institution, DAFs are vulnerable to fraud. It’s important to do your research and choose a DAF that has a strong track record of security.

Despite these risks, DAFs can be a valuable tool for charitable giving. By providing a convenient and flexible way to make donations, DAFs can help donors make a bigger impact on the causes they care about.

What is a Donor Advised Fund (DAF)?

A donor advised fund (DAF) is a charitable giving account that allows donors to make a lump-sum donation to a public charity and then recommend grants to be awarded over time. DAFs are often used by individuals, families, and corporations to make charitable gifts and receive immediate tax benefits.

DAFs are typically offered by community foundations, financial institutions, and other nonprofits. They are similar to charitable trusts, but they offer a number of advantages, including:

- Simplicity: DAFs are easy to set up and manage.

- Flexibility: DAFs allow donors to recommend grants to any 501(c)(3) organization.

- Tax benefits: Donors can receive an immediate tax deduction for their contributions to a DAF.

If you are considering making a charitable gift, a DAF may be a good option for you. DAFs offer a number of benefits that can make it easier for you to give back to your community.

How to make a grant from a DAF

To make a grant from a DAF, you can follow these steps:

- Log in to your DAF account.

- Select the grantee you want to make a grant to.

- Enter the amount of the grant.

- Provide any additional information required by the grantee.

- Click “Submit.”

Once you have submitted your grant request, it will be reviewed by the DAF administrator. If the request is approved, the grant will be sent to the grantee.

You can also make a grant from a DAF by contacting the DAF administrator directly.

How to make a grant from a DAF

VIII. How to make a grant from a DAF

To make a grant from a DAF, you will need to:

- Log in to your DAF account

- Select the grantee you would like to make a grant to

- Enter the amount of the grant

- Provide a description of the grant

- Click “Submit”

Once you have submitted the grant, it will be processed and the funds will be sent to the grantee.

You can also make a grant from a DAF by contacting the DAF administrator. The administrator will be able to help you set up the grant and process the funds.

IX. Tax implications of using a DAFWhen you contribute money to a DAF, you can claim an immediate tax deduction for the full amount of your contribution. This is the same tax deduction you would receive if you donated the money directly to a charity. However, there are a few important differences between donating to a DAF and donating directly to a charity.

First, when you contribute to a DAF, you are not actually giving the money away. The money remains in the DAF, and you can continue to make grants from the DAF over time. This can be beneficial if you are not sure which charities you want to support or if you want to spread out your giving over time.

Second, when you make a grant from a DAF, you are not required to itemize your deductions. This means that you can still claim the tax deduction for your grant even if you do not itemize your deductions on your tax return. This can be beneficial if you do not have a lot of other itemized deductions.

Finally, the tax implications of using a DAF can vary depending on the type of DAF you use. For example, some DAFs are subject to the same excise taxes as private foundations, while others are not. It is important to consult with a tax advisor to understand the specific tax implications of using a DAF in your situation.

FAQ

Q: What is a donor advised fund (DAF)?

A: A donor advised fund is a charitable giving vehicle that allows donors to make a lump-sum donation to a sponsoring organization, such as a community foundation or a nonprofit public charity. The donor then advises the sponsoring organization on how to invest the donated funds and make grants to charitable organizations.

Q: How do DAFs work?

A: When a donor establishes a DAF, they make a gift of cash or other assets to the sponsoring organization. The sponsoring organization then invests the donated funds and provides the donor with a charitable tax deduction for the full amount of their gift. The donor can then recommend grants from the DAF to any 501(c)(3) public charity.

Q: Who can use a DAF?

A: Anyone can use a DAF, regardless of their income or net worth. DAFs are a popular choice for individuals, families, and businesses looking to make a charitable gift and receive an immediate tax deduction.